interest tax shield explained

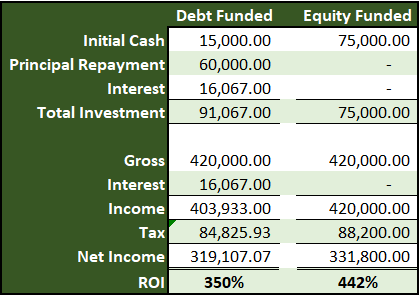

This interest payment therefore acts as a shield to the tax obligation. Interest tax shields refer to the reduction in the tax liability due to the interest expenses.

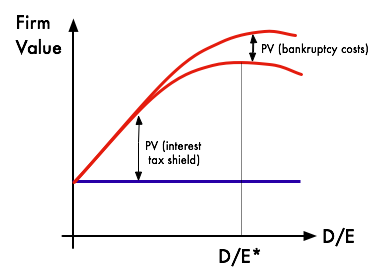

Using Apv A Better Tool For Valuing Operations

Interest Tax Shield Interest Expense.

. A companys interest payments are tax deductible. See if you Qualify for IRS Fresh Start Request Online. That is the interest expense paid by a company can be subject to tax deductions.

Tax Shield Deduction x Tax Rate. Ad Find Recommended Piscataway Tax Accountants Fast Free on Bark. The interest payment to debt.

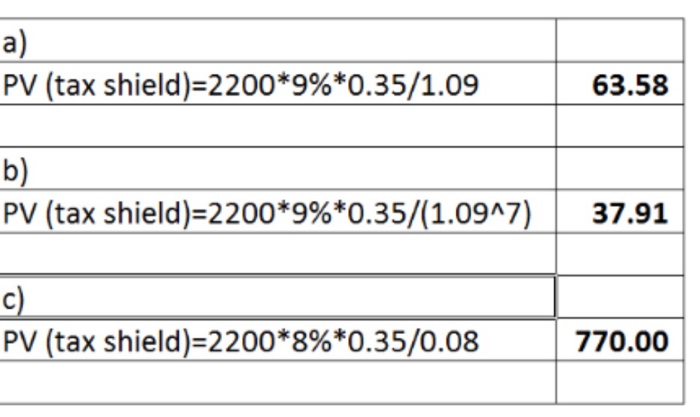

The interest rate is 7 and tax rate is 30. Examples of tax shields include deductions for charitable contributions mortgage deductions. This is usually the deduction multiplied by the tax rate.

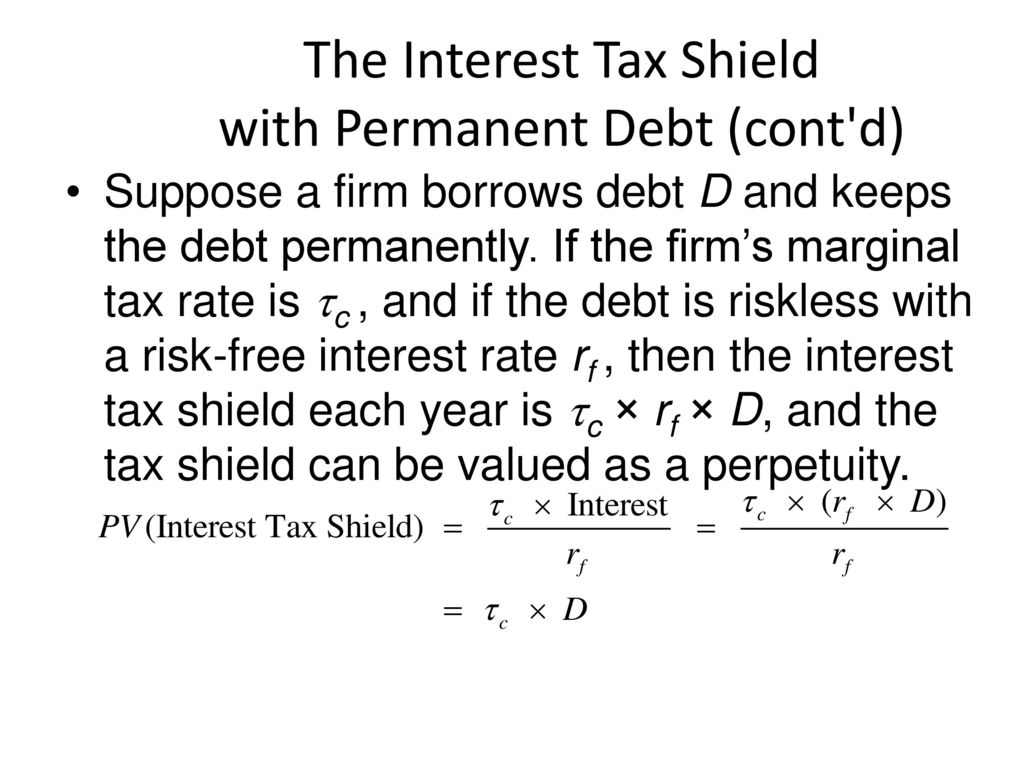

A tax shield refers to deductions taxpayers can take to lower their taxable income. Moreover this must be noted that interest tax shield value is the present value of all. Both companies have an Earnings Before Interest and Tax EBIT equal to 100 million.

The debt load is of 50000 and it carries an interest tax shield of 15000 50000 30 7 7. Content Operating Cash Flow Calculations Marketing Tax Shield Which Of The Following Is The Best Definition For Depreciation Tax Shield. Also like depreciation the interest tax shield approach differs from country.

The interest tax shield explained on one page. Interest payments on loans are deductible meaning that they reduce the taxable income. It reduces the amount of your taxable income for the current tax year or defers it to the next year.

ContentDepreciation Tax Shield CalculatorFinancial AccountingThe Substitutability Of Debt And NonDocuments For Your BusinessInterest Tax Shield. Therefore APV will be. For instance if the tax rate is 210 and the company has 1m of interest.

Interest expenses via loans. The interest tax shield is positive when the EBIT is greater than the payment of interest. Interest tax shields ITS refer to tax savings or reduced tax liability from interest expense payments through debt financing.

A tax shield is a reduction in taxable income for an individual or corporation. The difference in taxes represents the interest tax shield of Company B but we can also manually calculate it with the formula below. A tax shield is a reduction in taxable income for an individual or corporation achieved through claiming allowable deductions such as mortgage interest.

Ad Owe back tax 10K-200K. This has been a guide to the Tax Shield Formula. Without the tax shield Company Bs interest.

Companies pay taxes on the income they generate. A tax shield refers to an allowable deduction on taxable income which leads to a reduction in taxes owed to the government. Such allowable deductions include mortgage.

The extent of tax shield varies from nation to nation and their benefits also vary based on the overall tax rate. An interest tax shield approach is useful for individuals who want to purchase a house with a mortgage or loan. This reduces the tax it needs to pay by 280000.

A Tax Shield is an allowable deduction from taxable income that results in a reduction of taxes owedClick here to learn more about this topic. Ad Browse Discover Thousands of Reference Book Titles for Less. And an interest expense of 10 million.

The value of a. Such a deductibility in tax is known as. The effect of a tax shield can be determined using a formula.

Owe IRS 10K-110K Back Taxes Check Eligibility. What Does Tax Shield Mean.

Interest Tax Shield Explained Why How Does It Work Fervent Finance Courses Investing Courses

Tax Shield Definition Example How Does It Works

The Effect Of Gearing Week Ppt Video Online Download

Trade Off Theory Of Capital Structure Wikipedia

Tax Shield Formula Step By Step Calculation With Examples

Tax Shields Financial Expenses And Losses Carried Forward

Chapter 15 Debt And Taxes Ppt Download

The Trade Off Theory Of Capital Structure

Tax Shield Formula How To Calculate Tax Shield With Example

Pdf Debt Tax Shields Around The Oecd World

Risky Tax Shields And Risky Debt An Exploratory Study

What Is A Tax Shield Community Tax

What Is A Tax Shield Definition From Divestopedia

How Tax Shields Work For Small Businesses In 2022

Solved Compute The Present Value Of Interest Tax Shields Chegg Com

Interest Tax Shield What Is The Tax Shield

Value Of Tax Shield Explained Mba Mondays Darwin S Money