social security tax limit 2021

Between 32000 and 44000 you may have to pay. Under federal law people who are receiving Social Security benefits and who have.

:max_bytes(150000):strip_icc()/GettyImages-908062776-91d6c9a754fb45ab8de8513244b5a036.jpg)

Are Social Security Benefits Taxable After Age 62

This amount is known as the maximum taxable earnings and changes each year.

. Only the social security tax has a wage base limit. Married filing separately and lived apart from their spouse for all of 2019 with 25000 to 34000 income. The maximum earnings that are taxed have changed over the years as shown in the chart below.

Or Publication 51 for agricultural employers. Information for people who receive Social Security benefits. The Medicare portion HI is 145 on all earnings.

Year Maximum Taxable Earnings 1937-1950 3000 1951-1954 3600 1955-1958 4200 1959-1965 4800 1966-1967 6600 1968-1971 7800 1972 9000 1973 10800 1974 13200 1975 14100 1976 15300 1977 16500 1978 17700 1979 22900 1980 25900. More than 34000 up to 85 percent of your benefits may be taxable. Fast Facts Figures About Social Security 2021 Did You Know That 698 million people received benefits from programs administered by the Social Security Administration SSA in 2020.

For 2021 the first 142800 of your combined wages tips and net earnings is subject to any combination of the Social Security part of self-employment tax. Ad File State And Federal For Free With TurboTax Free Edition. Ad The Portion of Your Benefits Subject to Taxation Varies With Income Level.

Refer to Whats New in Publication 15 for the current wage limit for social security wages. The rate consists of two parts. The change to the taxable maximum called the contribution and benefit base is based on the National Average Wage Index.

What is the income limit for paying taxes on Social Security. If your Social Security income is taxable the amount you pay will depend on your total combined retirement income. How is Social Security taxed 2021.

124 for social security old-age survivors and disability insurance and 29 for Medicare hospital insurance. Its Estimated About 56 of Social Security Recipients Owe Income Taxes on Benefits. How to Calculate Your Social Security Income Taxes.

This is the largest increase in a decade and could mean a higher tax bill for some high earners. Filing single single head of household or qualifying widow or widower with 25000 to 34000 income. Married filing jointly with 32000 to 44000 income.

The increase for 2022 at 29 percent is less than the 37 percent increase for 2021. The amount liable to Social Security tax is capped at 142800 in 2021 but will rise to 147000 in 2022. The self-employment tax rate is 153.

Between 25000 and 34000 you may have to pay income tax on up to 50 percent of your benefits. Maximum Taxable Earnings En español If you are working there is a limit on the amount of your earnings that is taxed by Social Security. Separate HI taxable maximums of 125000 130200 and 135000 were applicable in 1991-93 respectively.

The maximum amount of Social Security tax an employee will pay in 2021 is 885360. In 2021 the Social Security tax limit is 142800 up from 137700 in 2020. In 2021 the Social Security tax limit is 142800 and in 2022 this amount is 147000.

58 million people were newly awarded Social Security benefits in 2020. After 1993 there has been no limitation on HI-taxable earnings. For the 2021 tax year which you will file in 2022 single filers with a combined income of 25000 to 34000 must pay income taxes on up to 50 of their Social Security benefits.

Tax rates under the HI program are 145 percent for employees and employers each and 290 percent for self-employed persons. Social Security and Medicare taxes. For earnings in 2022 this base is 147000.

You will pay tax on only 85 percent of your Social Security benefits based on Internal Revenue Service IRS rules. 55 of adult Social Security beneficiaries in 2020 were women. The 2021 tax limit is 5100 more than the 2020 taxable maximum of 137700 and 36000 higher.

The tax rates. However if youre married and file separately youll likely have to pay taxes on your Social Security income. In addition your future benefit amount will not increase once your income surpasses the maximum taxable earnings limit.

Get Rid Of The Guesswork And Have Confidence Filing With Americas Leader In Taxes. Employeeemployer each Self-employed Can be offset by income tax provisions. Listed below are the maximum taxable earnings for Social Security by year from 1937 to the present.

However you will. If you earn 142800 per year in. The 2022 limit for joint filers is 32000.

For the 2021 tax year single filers with a combined income of 25000 to 34000 must pay income taxes. Social Security recipients will also receive a slightly higher benefit payment in 2021. Fifty percent of a taxpayers benefits may be taxable if they are.

The Social Security portion OASDI is 620 on earnings up to the applicable taxable maximum amount see below. The Social Security taxable maximum is adjusted each year to keep up with changes in average wages. 9 rows Maximum Taxable Earnings En español If you are working there is a limit on the.

Also as of January 2013 individuals with earned income of more than in Medicare taxes. The wage base limit is the maximum wage thats subject to the tax for that year. The 765 tax rate is the combined rate for Social Security and Medicare.

If your combined income was more than 34000 you will pay taxes on up to 85 of your Social Security.

/GettyImages-963811020-4a28b09314ec43108714573b93e1fcae.jpg)

How Is Social Security Tax Calculated

What Is Fica Tax Contribution Rates Examples

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

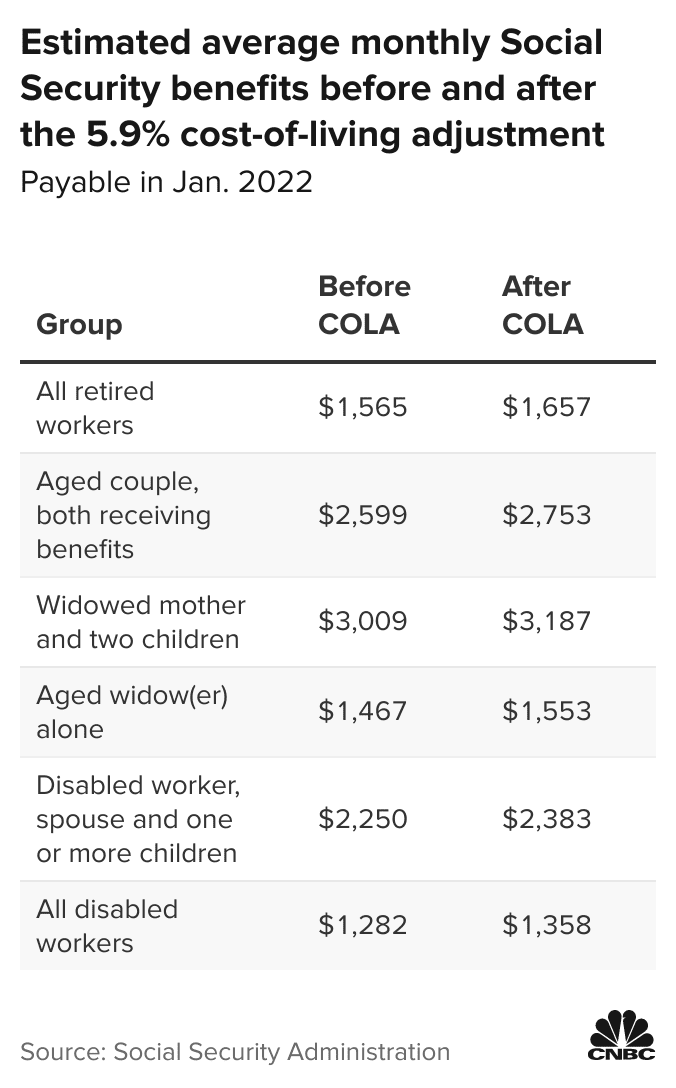

Social Security Cost Of Living Adjustment Will Be 5 9 In 2022 Biggest Annual Hike In 40 Years

/GettyImages-576720420-27eaa138a2e144d2b957315f18ef2725.jpg)

Social Security Tax Definition

2021 Social Security Earnings Limit Youtube Social Security Social Financial Decisions

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

Have You Ever Wondered How The Tfsa Contribution Limits Work What Investment Options Are Available To You What Money Sense Investing Money Personal Finance

Social Security Will Be Insolvent By 2033 The Washington Post

Budget 2022 Provision Of Social Security For Income Tax Assessees Need Of Hour In 2022 Income Tax Social Security Income

Social Security Wage Base Increases To 142 800 For 2021

/heroexportjourney-4229705-df42b41ba8f7483fba08a542a4eae4ac.jpg)

Social Security Tax Definition

Social Security Cost Of Living Adjustment Will Be 5 9 In 2022 Biggest Annual Hike In 40 Years

Payroll Accounting 2020 30th Edition Solutions Manual By Bieg Payroll Accounting Payroll Accounting

At What Age Is Social Security No Longer Taxed In The Us As Usa

2022 Wage Cap Jumps To 147 000 For Social Security Payroll Taxes

/GettyImages-1134937342-4f983d6e2462466b902206a0525d82b3.jpg)